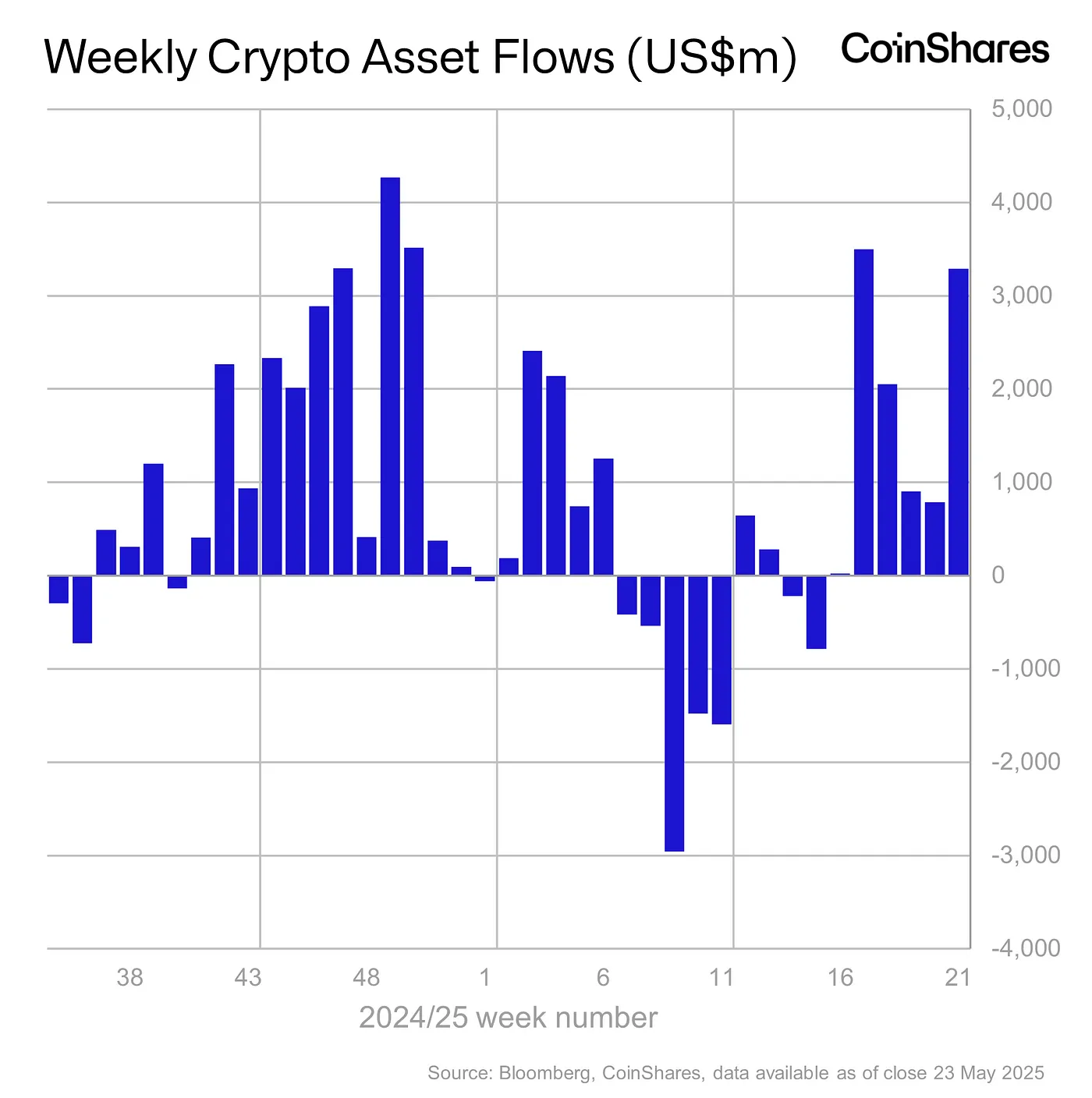

Crypto investment products attracted $3.3 billion in inflows last week as investors flocked to products issued by asset managers like BlackRock, Fidelity, and Grayscale, according to CoinShares' latest report.

The six-week streak of positive action briefly pushed total assets under management (AUM) to an all-time high of $187.5 billion and YTD inflows to $10.5 billion, higher than the previous $7.5 billion peak noted by CoinShares’ Head of Research James Butterfill last Monday.

Last week, the total cryptocurrency market cap rose over 6% to $3.5 trillion as bitcoin claimed a $111,800 ATH, according to The Block’s price page.

Weekly Crypto Asset Flows

XRP hits record outflows

As expected, Bitcoin led the surge with weekly inflows of $2.9 billion and now accounts for roughly a quarter of all crypto product inflows in 2025. Ethereum captured $326 million, its largest in 15 weeks. The continued bullish ETH sentiment followed a “standout performer” label the previous week.

While BTC and ETH saw significant inflows, XRP witnessed its largest outflow to date with $37.2 million in exits. The flight from XRP funds ended a “remarkable 80-week inflow streak”, Butterfill wrote.

The U.S. dominated regionally with $3.2 billion in inflows. Germany, Australia, and Hong Kong followed with $41.5 million, $10.9 million, and $33.3 million, respectively. Swiss investors took profits, resulting in $16.6 million in outflows.