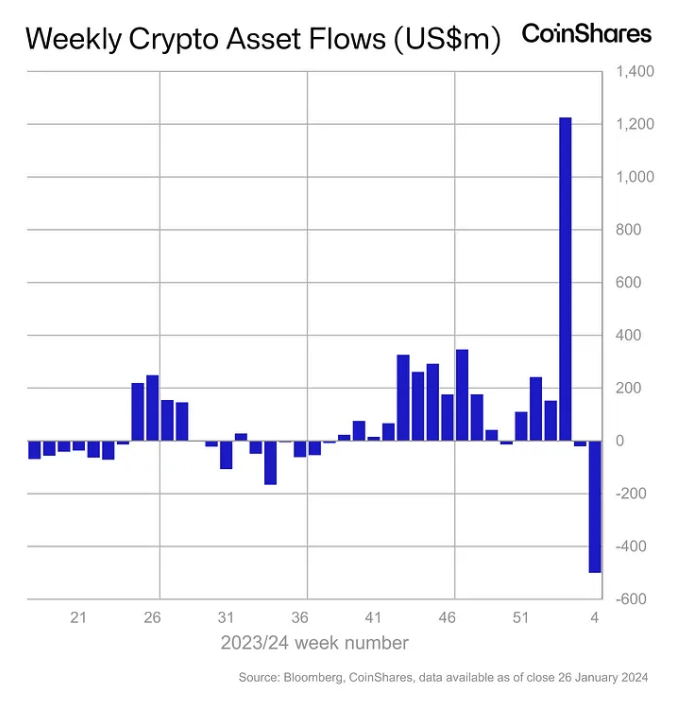

Crypto funds at asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares and 21Shares saw net outflows totaling $500 million globally last week, according to CoinShares’ latest report.

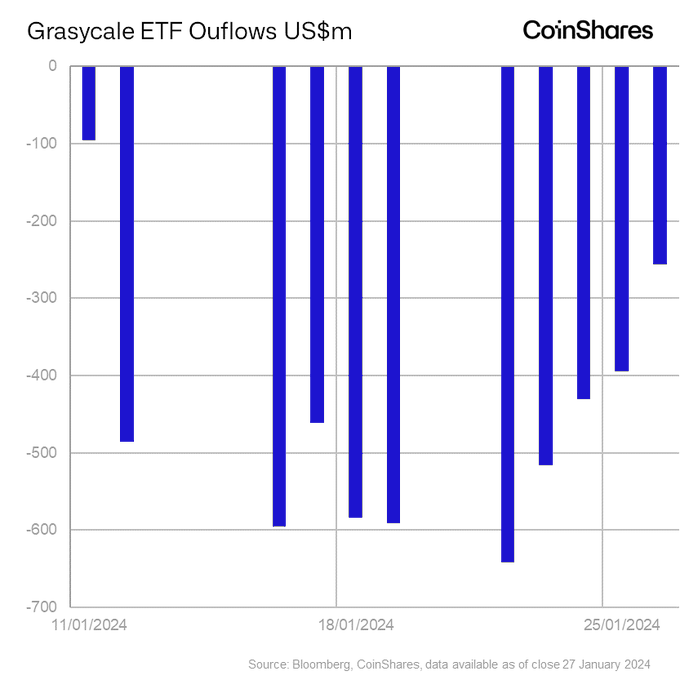

Grayscale’s higher-fee converted spot bitcoin exchange-traded fund (GBTC) continued to dominate outflows, with $2.2 billion exiting the exchange-traded fund. However, the most recent data suggests that impact is beginning to subside, with daily outflows falling consecutively over the week, CoinShares Head of Research James Butterfill wrote.

GBTC outflows. Image: CoinShares.

GBTC’s strong outflows contrast with inflows from the nine newborn spot bitcoin ETFs totaling $1.8 billion last week, led by $744.7 million from BlackRock’s IBIT and $643.2 million from Fidelity’s FBTC. Since launch on Jan. 11, the nine new ETFs have collectively registered around $5.8 billion in inflows and GBTC $5 billion in outflows, leading to a total net inflow of $759.4 million.

Bitcoin  BTC -0.62% is down around 14% from a peak of $49,000 the day the spot bitcoin ETFs launched to a current price of $42,252, according to The Block's price page. “We believe that much of the price falls, despite these positive flows, was due to bitcoin seed capital being acquired prior to Jan. 11,” Butterfill said.

BTC -0.62% is down around 14% from a peak of $49,000 the day the spot bitcoin ETFs launched to a current price of $42,252, according to The Block's price page. “We believe that much of the price falls, despite these positive flows, was due to bitcoin seed capital being acquired prior to Jan. 11,” Butterfill said.

Weekly crypto asset flows. Images: CoinShares.

Bitcoin dominates, led by the US market

Unsurprisingly, bitcoin investment products dominated, witnessing $479 million in net outflows. Short-bitcoin funds attracted further inflows of $10.6 million.

Most altcoin-based funds also registered outflows. Ether investment products saw $39 million in outflows last week, with Polkadot and Chainlink funds losing $0.7 million and $0.6 million, respectively.

However, Solana products bucked the trend with $3 million worth of inflows, and blockchain equities continued a ten-week inflow streak, adding $17 million.

Regionally, U.S.-based funds dominated with net outflows of $409 million, while Switzerland and Germany witnessed outflows of $60 million and $32 million, respectively. Brazil registered the largest net inflows of $10.3 million.

“Recent price declines prompted by the substantial outflows from the incumbent ETF issuer (Grayscale) in the U.S. totaling $5 billion, have likely prompted further outflows from other regions,” Butterfill said.