Often times, traders who expect the market to move significantly, but are unsure of the direction of the change, use an option strategy known as Strangles. The following section details the definition of Strangles and how to use this option strategy in trading.

Definition of Strangles

Strangles are constructed by buying a put option below the current price of the underlying asset + buying a call option above the current price of the underlying asset. Strangles are profitable when the price of the underlying asset fluctuates significantly, either up or down. However, unlike the straddles, the profit range is wider than the straddles.

Long Strangle

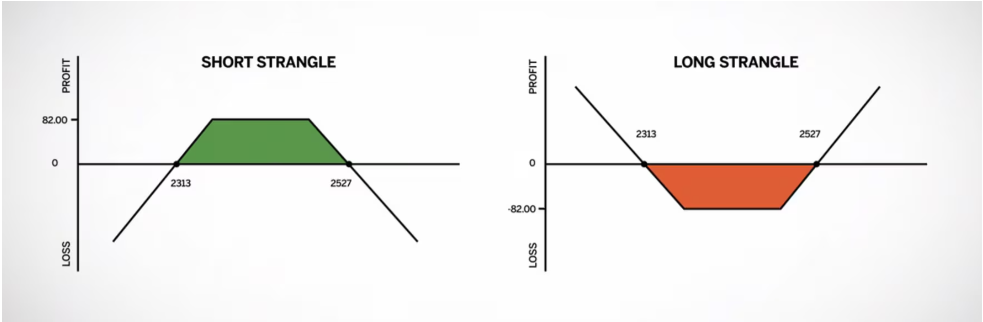

If a trader believes that a change in the market is imminent, but is unsure of its direction, he or she will buy Strangles, i.e., a call option with a strike price higher than the current price of the underlying asset, and a put option with a strike price lower than the current price of the underlying asset. The break-even point is the strike price of the call option plus the cost of the Strangles combination and the strike price of the put option minus the cost of the Strangles combination. The loss is limited to the cost of the spread. If the market is between the two strike prices at expiration, this is when the loss is highest. Since the Strangles consists entirely of long options, it will lose its premium due to time decay. The cost of time decay is highest if the market is between the two strike prices. But because this Strangles buys both calls and puts, its profit potential is infinite in either direction.

Short Strangle

Traders sell Strangles if they believe the market will stagnate for some time in the future, selling a call option above the current price of the underlying asset while selling a put option below the current price of the underlying asset.and as long as the market price does not significantly exceed the strike price, they can profit from the time decay of the option. The break-even point is the same for both long and short strangles, and for short strangles, profitability is highest when the price of the underlying asset at the time of strike is between the two strike prices. But in either direction, the loss potential is infinite.