What Token Unlocks Really Mean: Supply Changes Over Time

In the cryptocurrency market, “token unlocking” refers to the process by which tokens that were originally locked and temporarily unable to be freely transferred or sold gradually become circulating according to rules written in advance or schedules determined through governance. Put more intuitively, this is a form of staged usability: on paper, you may already own these tokens, but you cannot actually use them until certain conditions are met. Projects need to discuss unlocking because token prices and market fluctuations are often not driven by the static figure of “total supply,” but rather by how much newly “sellable circulating supply” is introduced within a specific time window. This is the variable most easily overlooked by beginners in token economics, yet it has the greatest impact on trading outcomes.

To understand unlocking, one must first understand “locking” and how it is executed. Locking is typically implemented by smart contracts, which specify the claimable allocation for a given address or category of participants—such as the team, investors, foundation, or ecosystem incentives—the start time, the release cycle (vesting schedule), and whether a “cliff” exists. A cliff refers to a period during which no tokens are released at all, after which releases begin. As time advances, holders can only claim the portion that has vested, or tokens are released by a custodian according to predefined rules. Whether enforced through on-chain contracts or off-chain custody, the economic meaning is the same: potential sell-side supply is shifted from the present into the future, and the supply path becomes predictable. For this reason, vesting schedules are not merely technical details, but a point of intersection between financing terms, incentive design, and market expectation management. The more concentrated the release, the greater the short-term supply shock; the smoother the release, the closer the market impact resembles gradual inflation.

Why Tokens Are Locked: Incentives and Risk Control

The most common and pragmatic reason for locking tokens is to constrain the short-term behavior of early participants, reduce the risk of extreme sell-offs during the initial launch phase, and thereby protect later investors while preserving relatively fair price discovery. Many projects allocate tokens at lower costs during seed rounds, private rounds, or team incentive programs. If these holdings were to become fully liquid when market liquidity is still shallow and market awareness has not yet formed, a small number of holders could complete cash-outs in a very short period, leading to sharp price declines, loss of confidence, and cascading effects on ecosystem recruitment, exchange relationships, and external partnerships. The function of locking is to delay monetization, aligning value realization more closely with delivery progress. From a governance perspective, it also reduces moral hazard by extending the time horizon over which teams and core contributors realize returns, effectively transforming incentives into long-term contracts that encourage sustained development, network security maintenance, and ecosystem operations.

Beyond incentive alignment, token locking is frequently used to support compliance and custodial considerations. In jurisdictions where the regulatory classification of tokens or disclosure obligations remain contested, clearly defined and transparent unlocking rules can reduce uncertainty and enhance credibility. For ecosystem incentives, staged release mechanisms lower the likelihood that one-off subsidies are immediately extracted through short-term arbitrage, increasing the probability that resources are retained in the form of developer engagement, application growth, and user adoption.

In addition, locking is often used to support compliance and custodial arrangements, especially when facing disputes over a token’s securities characteristics or disclosure requirements across different jurisdictions. Clear unlocking rules can reduce uncertainty and improve transparency. At the same time, staged releases of ecosystem incentives lower the probability that one-off subsidies are extracted through short-term arbitrage, making it more likely that resources accumulate into developer participation, application deployment, and user growth.

No Single Model: Different Projects, Different Unlock Paths

In real-world projects, there is no single canonical model for locking and unlocking; designs vary with financing structures and stages of network development. Public blockchains such as Solana have adopted varying degrees of lockups and phased releases in early financing and team allocations, with the goal of mitigating concentrated sell pressure at launch and creating a time window for ecosystem growth. Newer blockchains such as Aptos and Sui likewise employ relatively clear vesting schedules, releasing allocations to teams, investors, and foundations in stages, and disclosing these schedules so that markets can form expectations about future supply changes in advance. Ethereum followed a different early path: its initial distribution was completed through a crowdsale, and subsequent supply changes have been driven primarily by protocol-level issuance and network incentive mechanisms rather than concentrated releases tied to private-round unlock dates. Viewed together, these cases support a single conclusion: locking is not equivalent to “higher project quality.” It is instead an institutional arrangement that balances financing, incentives, and market stability, with the critical factors being clarity of rules, smoothness of release, and alignment between recipients and network objectives.

Reading Unlock Data: From Events to Supply Analysis

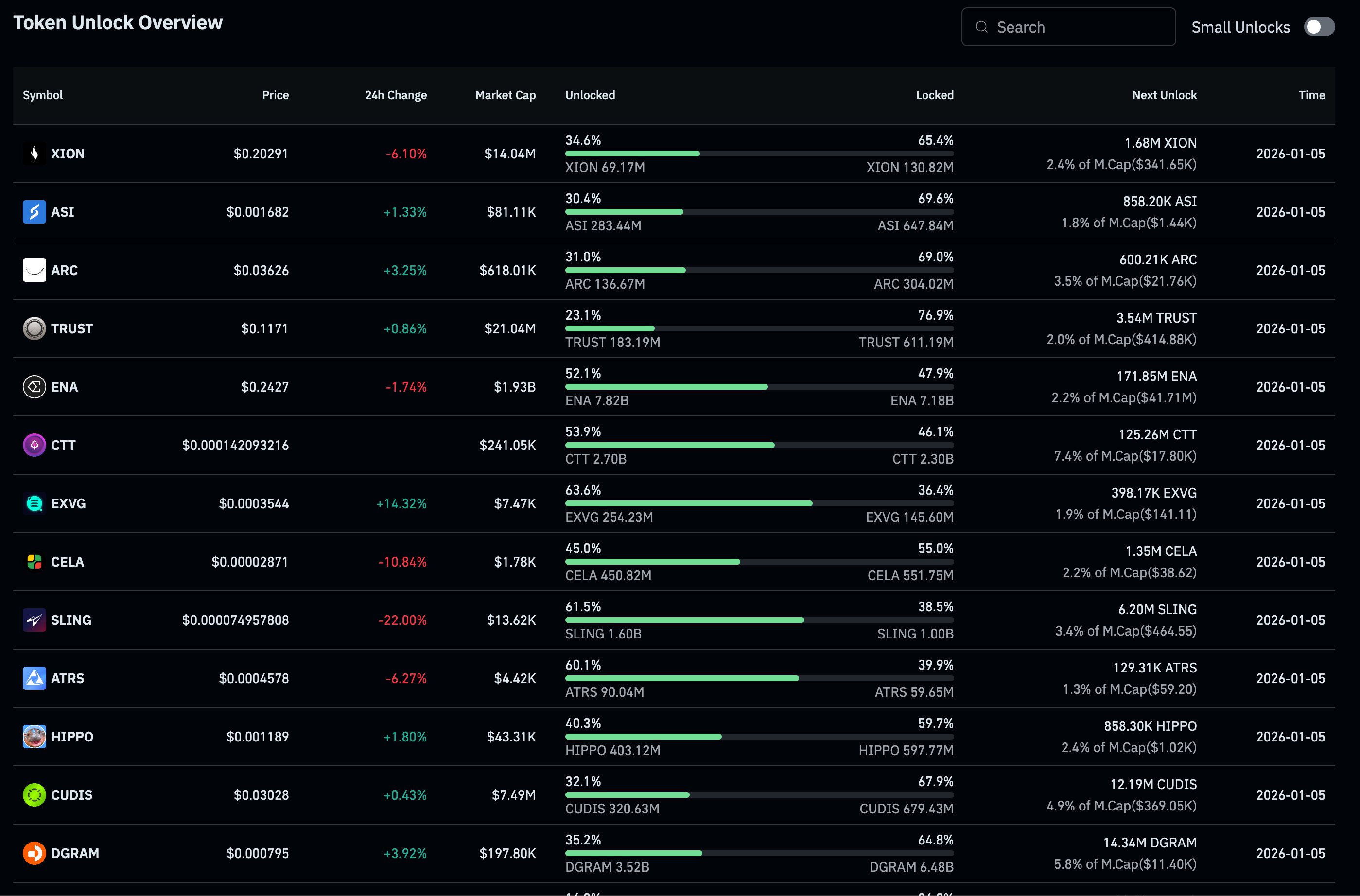

Translating these concepts into an operational reading framework, token unlock dashboards such as CoinGlass provide an intuitive structure. The overview page typically presents, side by side, the token price, 24-hour price change, market capitalization, the proportion already unlocked, the proportion still locked, as well as details of the “next unlock,” including the number of tokens, the corresponding USD value, and the scheduled date. Taking XION in the screenshot as an example, the page shows that approximately 34.6% has already been unlocked (about 69.1671 million tokens), while about 65.4% remains locked (roughly 131 million tokens). The next unlock consists of 1.6837 million tokens scheduled for 2026-01-05, with an estimated value of about USD 344,300, representing roughly 2.4% of its market capitalization. This set of figures effectively quantifies “short-term supply shock” into a ratio that can be directly compared against market liquidity.

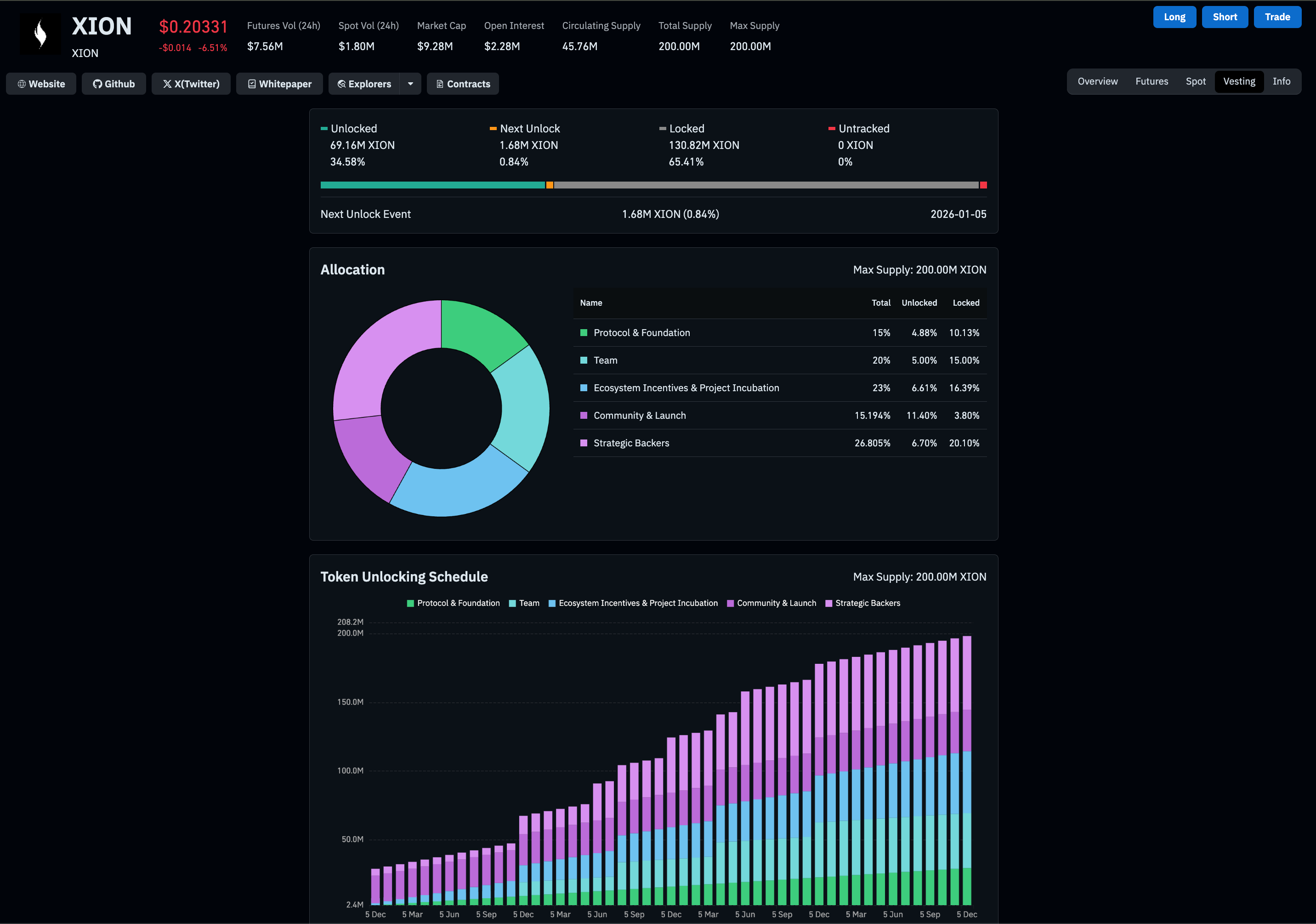

Looking further at ASI, ARC, and TRUST on the same page, the absolute sizes of their upcoming unlocks differ significantly. However, the dashboard simultaneously reports each unlock as a percentage of market capitalization, implicitly reminding the reader not to focus solely on “how many tokens are being unlocked,” but rather on “how large the unlock is relative to the market’s capacity to absorb it.” Clicking into XION’s detail page reveals a more granular, two-layer structure. The first layer consists of basic fundamentals such as derivatives or spot trading volume, circulating supply, and total supply. The page indicates a circulating supply of approximately 45.7667 million tokens and a total supply of about 200 million tokens, which are used to assess whether market depth at the time of unlocking is sufficient to absorb the additional supply. The second layer covers the allocation structure and unlock history. The allocation chart breaks the token supply into Protocol & Foundation (15%), Team (20%), Ecosystem Incentives & Project Incubation (23%), Community & Launch (15.194%), and Strategic Backers (26.805%), providing context for evaluating which categories of holders will be involved in future unlocks and how they may behave.

The impact of token unlocks is typically two-sided. On the risk side, an increase in circulating supply can generate sell pressure, especially when the unlocked tokens are primarily held by financial investors, market sentiment is weak, or trading depth is insufficient, conditions under which price volatility tends to be amplified. Inadequate disclosure can further trigger a “sell first” reflex driven by fear. On the benefit side, increased circulation can improve market depth; unlocked tokens may be staked to enhance network security, or deployed for ecosystem funding and incentive distribution, thereby supporting real usage. In addition, the reduction of uncertainty itself can contribute to improved overall market expectations.

For readers who already possess a foundational understanding, a more effective mental model is to treat unlocking as a “time-based supply shock.” Assessing price pressure should not be limited to a single calendar date, but should instead consider whether releases are concentrated or dispersed, who the recipients are, whether there is genuine demand to absorb the newly released supply, and whether the project’s fundamentals are improving in parallel during the unlock window. Looking ahead, best practices are likely to emphasize verifiability and predictability: more projects will deploy vesting contracts directly on-chain and provide transparent query interfaces to reduce information asymmetry; at the same time, locking mechanisms may increasingly shift from passive constraints toward active choices linked to contribution, staking, and long-term participation, allowing tokens to better function as instruments of network ownership and coordination.