The nine new spot Bitcoin exchange-traded funds have now amassed more than 150,000  BTC +2.64% ($6.5 billion) in assets under management, excluding Grayscale’s converted GBTC fund, according to data from K33 Research.

BTC +2.64% ($6.5 billion) in assets under management, excluding Grayscale’s converted GBTC fund, according to data from K33 Research.

These ETFs are BlackRock (IBIT), Fidelity (FBTC), Bitwise (BITB), Ark 21Shares (ARKB), Invesco (BTCO), VanEck (HODL), Valkyrie (BRRR), Franklin Templeton (EZBC) and WisdomTree (BTCW).

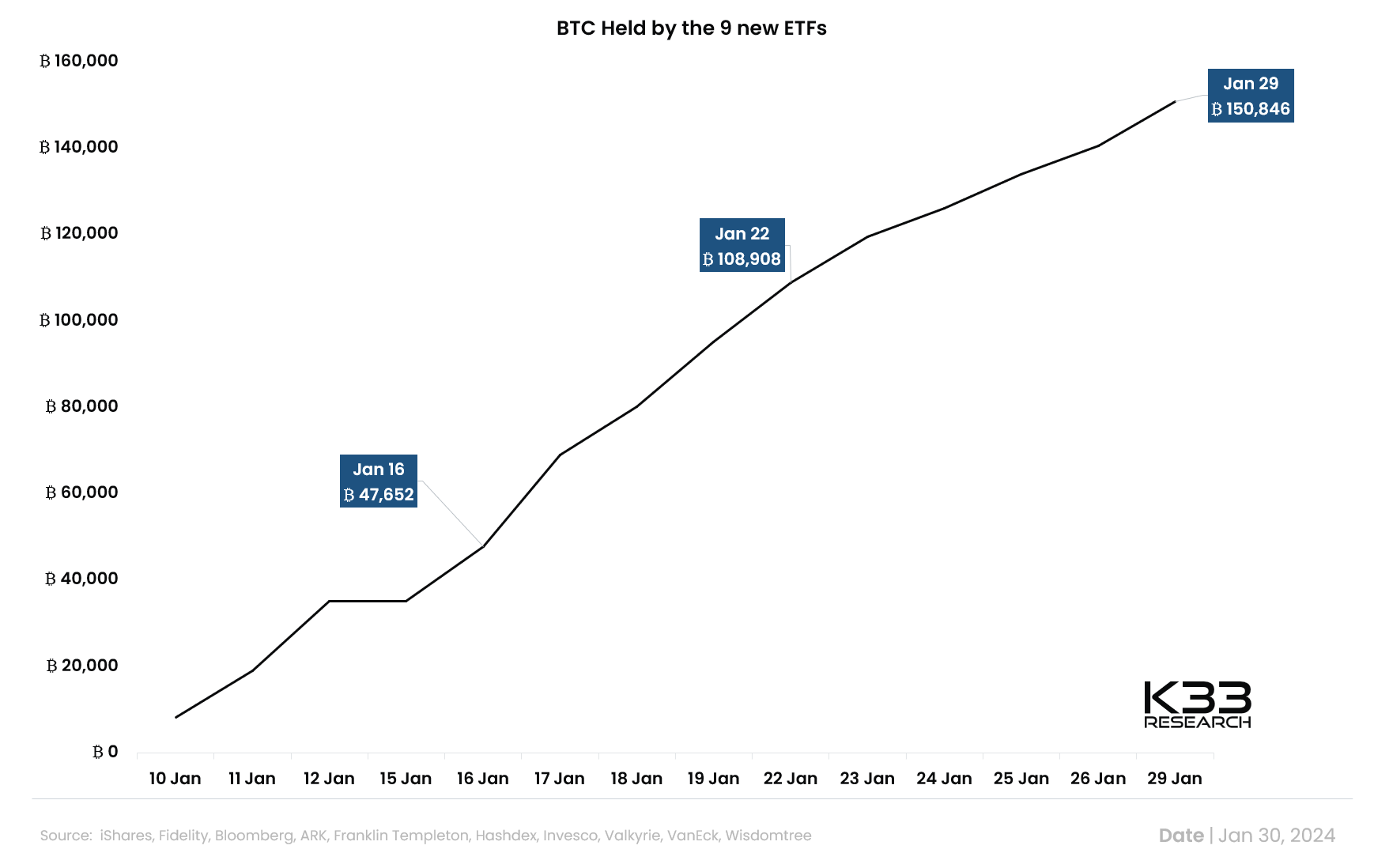

In total, the new ETF holdings reached 150,846 BTC as of Monday, up from 108,908 BTC on Jan. 22 and 47,652 BTC on Jan. 16. This excludes GBTC, which has seen the value of its assets under management fall by 126,482 BTC ($5.5 billion) since the ETFs launched on Jan. 11, according to BitMEX Research.

BTC held by the nine new ETFs. Image: K33 Research.

GBTC’s spot bitcoin ETF market share by trading volume has also fallen significantly over the period, nearly halving from a peak of 63.9% on Jan. 17. It has dropped from 49.1% to 36.4% over the last few days alone, according to The Block’s data dashboard. The cumulative volume for the ETFs now stands at over $25 billion.

Net spot bitcoin ETF inflows hit $1 billion

Total net inflows for spot bitcoin ETFs returned to more than $1 billion yesterday, according to BitMEX Research data — recovering after four days of net outflows last week. The newborn nine have registered a total $6.25 billion of inflows, while Grayscale’s converted GBTC fund has witnessed a total $5.23 billion in outflows.

Daily inflows for Fidelity’s FBTC and BlackRock’s IBIT alone surpassed GBTC’s outflows on Monday for the first time since Jan. 11. FBTC registered inflows of $208.2 million and IBIT $198.4 million.

GBTC’s $191.7 million worth of outflows yesterday continues a five-day streak of reducing outflows and represents the lowest daily outflows since launch day — leading to net inflows of $255.6 million for the day.

BlackRock’s IBIT surpasses AUM of all Canadian bitcoin ETFs combined

BlackRock’s U.S. spot bitcoin ETF also surpassed the assets under management of all Canadian bitcoin ETFs combined yesterday, reaching 56,621 BTC — currently worth around $2.5 billion.

The AUM of all Canadian bitcoin ETFs, such as the CI Galaxy Bitcoin ETF and Purpose Bitcoin ETF, stands at 55,016 BTC ($2.4 billion), according to K33 Research. Fidelity’s U.S. spot bitcoin ETF (FBTC) is also on course to reach the milestone, having amassed 51,064 BTC as of yesterday.

Bitcoin exposure: All Canadian ETFs vs. BlackRock and Fidelity. Image: K33 Research.